|

| Beans post their highest daily gain since December 11th and have now actually taken back all of the losses since the day of the brutal USDA report.

Although they haven't amounted to much, corn is green for the 4th day in a row, the longest streak since the end of November into early December.

Wheat closed a dime off of it's highs, ending unchanged and breaking it's 4 day rally.

Why have the markets found some footing?

Mainly it's just the funds. The sharp 3 week downtrend was mainly due to fund selling, and it seems like they view this area as a decent spot to stop the selling and reevaluate.

However, we haven't seen a big wave of buying either which is slightly depressing and creates choppy trade. But it's better than the blood bath we have seen recently.

South America weather remains mostly cooperative, the weather Brazil sees over the next month and a half will likely dictate their crop size.

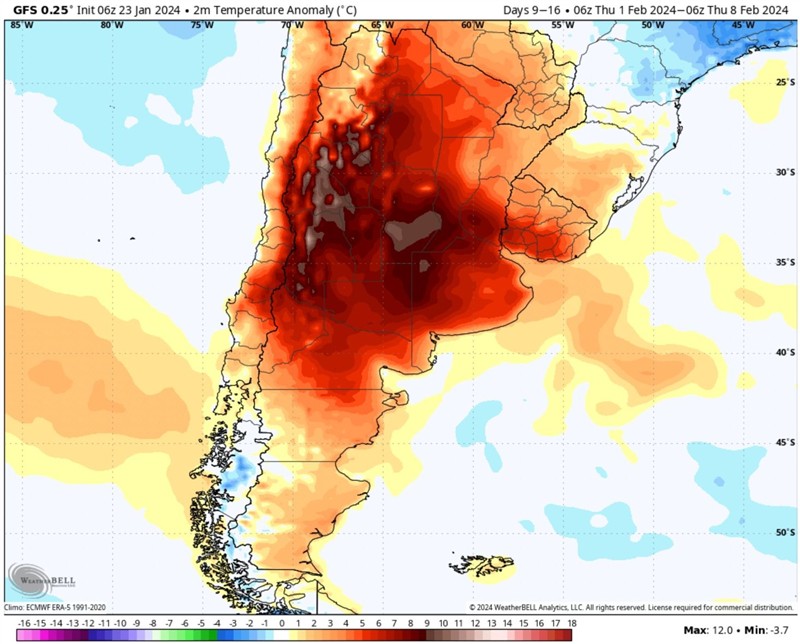

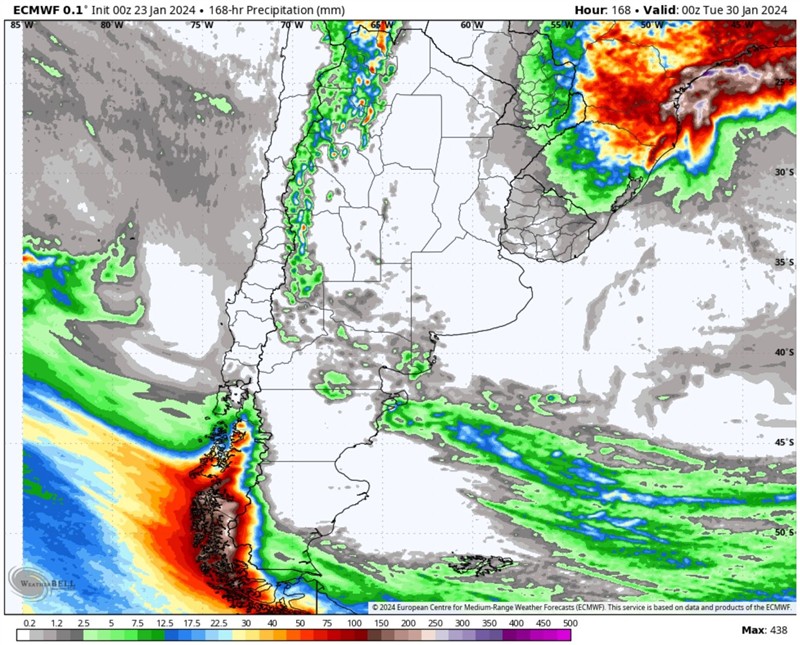

However, despite Argentina having an amazing crop, they are now expected to see some really hot and dry weather the next two weeks. Which could potentially do some damage and was another reason beans where higher.

It’s basically July in Argentina right now. So they still need rain. (Argy 7-day forecasts below)

Then we have a continuation of people working their estimates lower for the Brazil corn crop. The USDA is at 127 while most are throwing numbers around 115 to 120. Even CONAB is at 117.5 million. You'd think Brazil's USDA might have a better guess than the USA's right?

The farmer group Aprosoja is rumored to announce that they think second crop corn planting will be down -50% from last year. Would be big for corn if true.

The funds hold some of the shortest positions on record. They hold a net short position across all 7 major grain and oilseed futures for the first time since September of 2019.

They also hold the shortest corn position for this time of year in record. Sitting short -260k contracts.

So what happened the last time they were this short?

Read the rest of todays market update where we go over what happened the last time the funds where this short, the Brazil corn situation, who should be using courage calls vs puts & more

Read Here: https://txt.so/uNCQep

Edited by Mr.Grain 1/23/2024 19:42

(IMG_9935 (full).JPG) (IMG_9935 (full).JPG)

(IMG_9936 (full).JPG) (IMG_9936 (full).JPG)

Attachments

----------------

IMG_9935 (full).JPG (120KB - 237 downloads) IMG_9935 (full).JPG (120KB - 237 downloads)

IMG_9936 (full).JPG (188KB - 226 downloads) IMG_9936 (full).JPG (188KB - 226 downloads)

| |

|

Market Comments

Market Comments