|

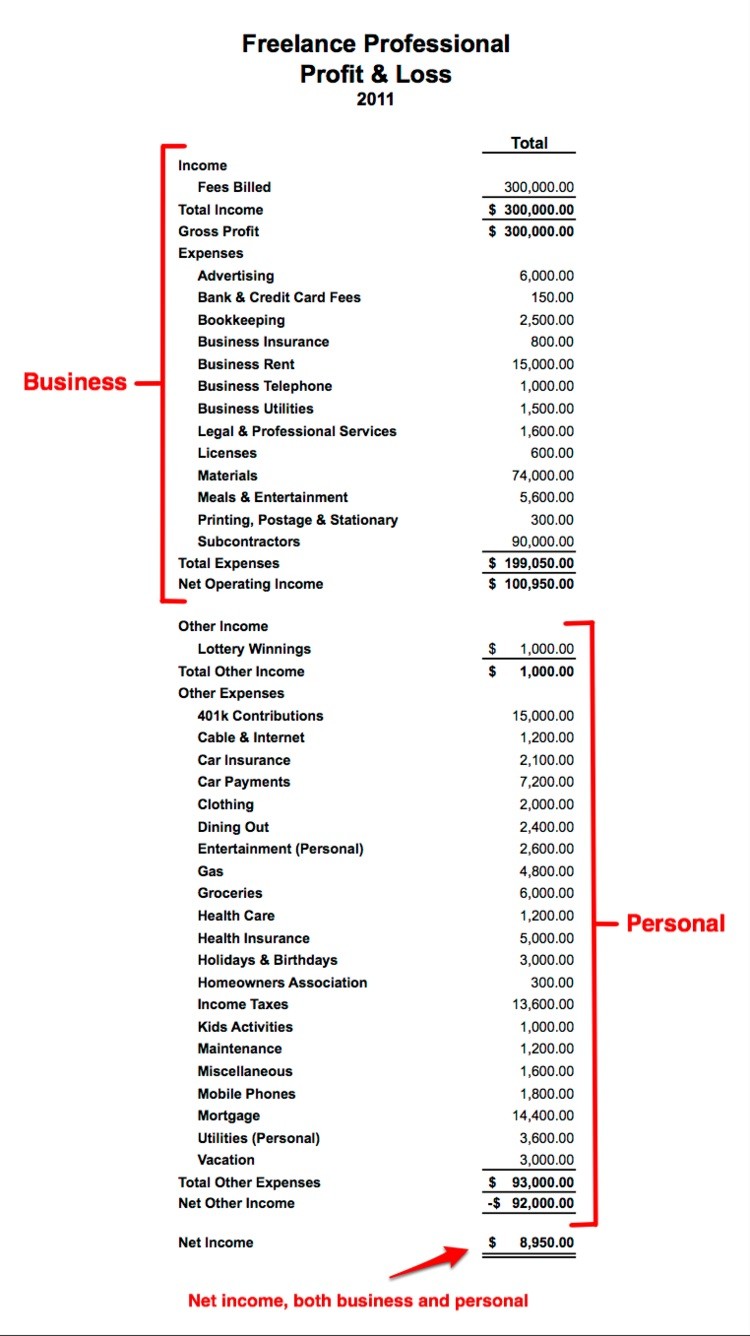

NE Nebraska | Our primary income and expense accounts are set up according to what is on a Schedule F, similar to what you described. Our personal and non-taxable transactions are set up in the chart of accounts as "other income" or "other expense". By doing it this way the top portion of a Profit & Loss will show your business income and expenses and "Net operating income" for your primary business and the bottom half will show personal income and expenses. The very bottom line will show your overall net income (or loss) from all operations. See the picture for an example I found online.

I don't understand your use of the equity category for taxable non farm income and non taxable non farm income. Given what you're trying to do, I'd set those up as "other income"

If you or your wife happen to write out a check that includes both business & non-business items, then you can make a split in the transaction so that part of it could be put as a business expense and part of it as a personal expense.

Edited by farm160 2/5/2018 20:58

(Sample Profit and loss.jpg) (Sample Profit and loss.jpg)

Attachments

----------------

Sample Profit and loss.jpg (142KB - 329 downloads) Sample Profit and loss.jpg (142KB - 329 downloads)

| |

|

quickbooks accounts setup? help.

quickbooks accounts setup? help.