|

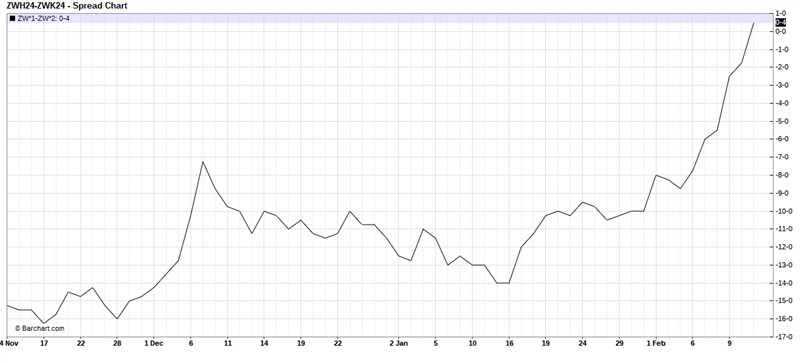

| The biggest thing that has been happening in the wheat market is the Chicago spreads.

We had a huge carry not too long ago, now we have a small inverse.

Take a look at this spread chart. On January 16th we were at a -14 carry now we are at a slight inverse.

From a commercial standpoint, one of the first things you are taught to get grains to move is to:

A.) Improve basis

B.) Take out the carry in the market or invert the market

C.) When that doesn't happen, the last thing to get the grain to move is the futures will rally.

If you look at it from a fundamental standpoint now vs a month ago, the outlook is a lot more bullish.

When the market is at a carry, they are paying you to store your grain, that is bearish because it means they are paying you more for later. Meaning they don't have enough demand upfront and there is more supply than demand. That is bearish.

When the market is at an inverse, the crop is worth more upfront. Meaning there is more demand than there is supply. That is bullish.

(download (5) (full).png) (download (5) (full).png)

Attachments

----------------

download (5) (full).png (52KB - 128 downloads) download (5) (full).png (52KB - 128 downloads)

| |

|

Wheat spreads

Wheat spreads