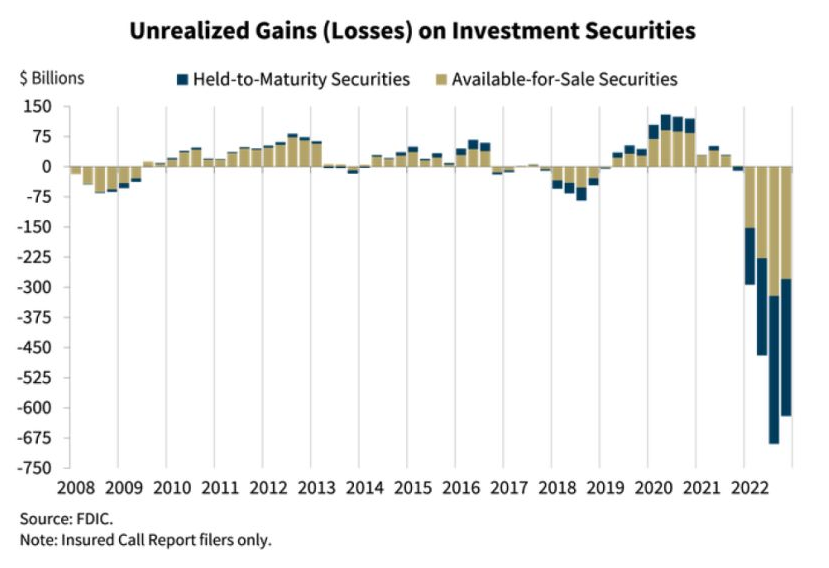

This Banking Crisis is far worse than that of 2007-2009. The reason for this is that this involves the Yield Curve which EVERY bank is involved in. Money was too cheap with artificially low-interest rates and thus it was basically free for the banks so they plowed it into the long term for the best yield. Now that the Ukraine War has been unleashed by the Biden Administration which is using Ukraine to weaken Russia for Regime Change directed by the Neocons, this has undermined our banking system and the economy from which the Fed cannot reverse the damage on the War and the shortages set in motion by the COVID lockdowns. Here is the chart for Unrealized Losses (URL). The FDIC Acting Chairman remarked:

"The combination of a high level of longer–term asset maturities and a moderate decline in total deposits underscores the risk that these unrealized losses could become actual losses should banks need to sell securities to meet liquidity needs."

-Martin Gruenberg, Acting Chairman of the FDIC, 2/28/2023

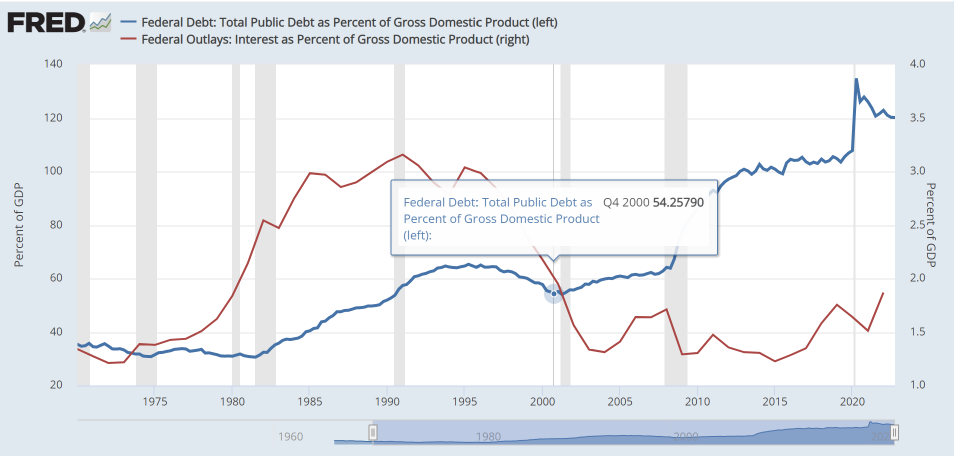

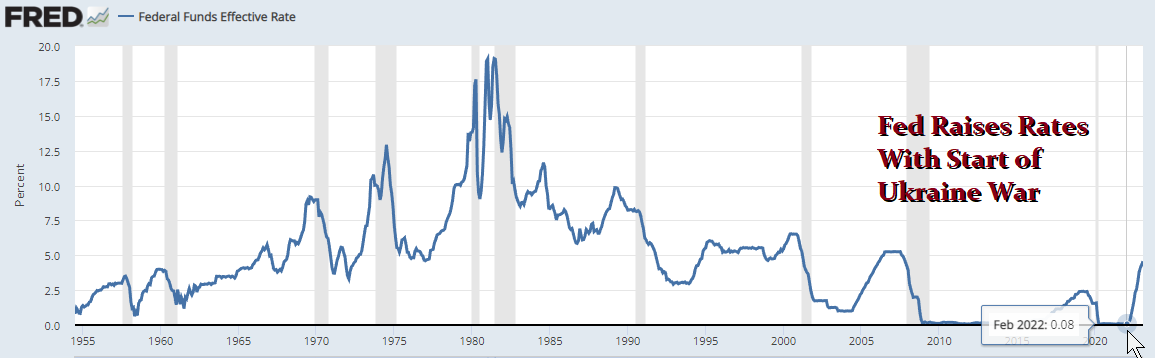

This chart actually shows the core of the crisis. The interest rates were held artificially low for way too long and that allowed the government debt to expand, but it also influenced the banking industry to take demand deposits that were virtually FREE MONEY and buy the long-term debt to capture the greatest potential spread for profit. Now that rates are rising, the first show to fall is the banking system. The next shoe will be the Sovereign Debt Crisis. The Fed is powerless to stop inflation and it cannot cope with this debt crisis with an endless war in Ukraine and total fiscal irresponsibility in the Biden Administration. Over the past 14 months, the Fed has raised Fed Funds 450 bps, from 0.25% to 4.75%. Rate increases resulted in the bear market in long-term bond values, but the smart money realizes this is set in motion by the Neocons and their control of the Biden Administration to conquer Russia. A 2-year note at 3% falls in value when the rate is 4.75% for you must compensate for what would be a 4.75% yield. Thus, that is discounted from the face value and that results in a loss to the bank. The Banks hold US Treasuries and Agency paper for liquidity purposes since they are AAA - no risk except the yield. When the people become afraid of the bank going bust, they withdraw deposits and that forces the bank to sell its treasurers for cash and which produces a loss when the yield has risen higher than the paper yield that they bought. Most small banks are clueless about managing risk. SVB and Signature, pro-Democratic banks, were WOKE and as such were more concerned about race, and gender that qualifications have become secondary. Therefore, this BANKING CRISIS is far worse than 2007-2009 because this impacts every bank whereas the Mortgage-Backed Crisis impacted ONLY those banks that were buying that nonsense.

There are people claiming the Fed will now restart QE. That will not even address this issue. The Fed would have to lower rates and abandon inflation that it knows is being created by Biden;'s war on Russia. The Fed did NOTHING about inflation between 2020 and 2022. It began raising rates just a couple of weeks after the Ukraine War began. The ONLY way to end the inflation is to stop funding Ukraine and seek peace. But the Neocons want Regime Change in Russia and they do not care at all about Americans or our economy. I do not see how Powell can get out of this crisis for he is screwed in both directions. |

There will be bank failures caused by commercial real estate losses

There will be bank failures caused by commercial real estate losses